Wealthramp

Designing a refreshed visual identity, enhanced user experience, and content strategies for a fiduciary matching service.

Aligning investors with advisors through matching algorithms.

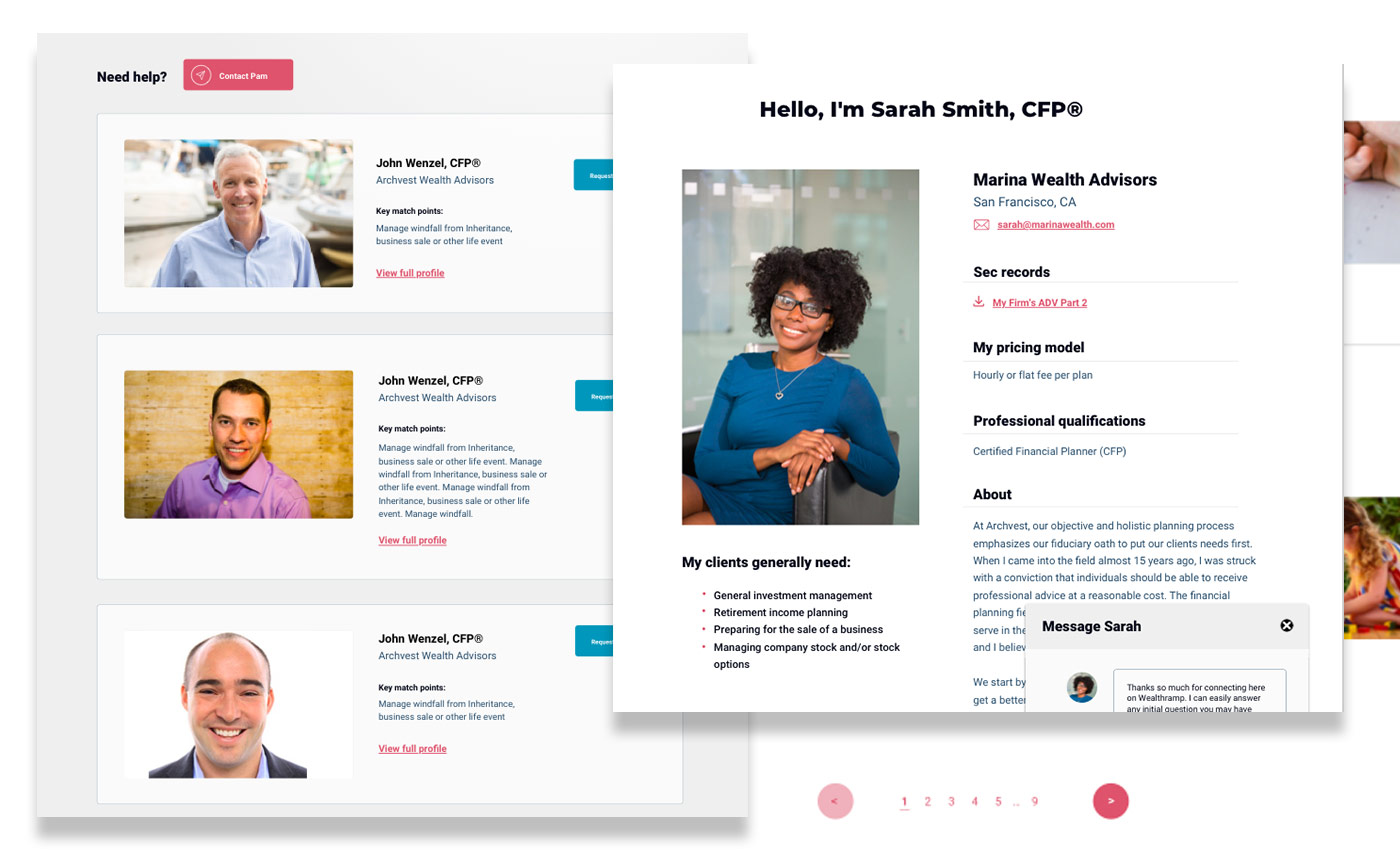

Wealthramp, a fiduciary matching service, connects investors with up to three best-in-class fiduciary financial advisors tailored to their specific needs and priorities. The process involves users answering a series of questions, with an algorithm determining the optimal matches based on their responses. However, Wealthramp was facing challenges with its existing digital experience: the user interface did not reflect the professionalism expected in the financial industry, and the site's content organization was ineffective, leading to confusion and inefficiencies.

Graham Agency was tasked with refreshing Wealthramp's visual identity, enhancing the user experience (UX) and user interface (UI) design, and implementing a more effective content strategy to improve usability and content discoverability.

The Core Challenge:

Driving Sign-Ups for Advisor Connections

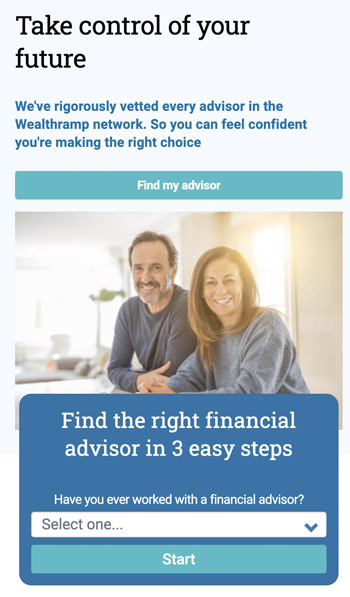

The primary challenge was to create an experience that not only encouraged users to complete the questionnaire and trust the algorithm to match them with the most appropriate fiduciary advisors but also seamlessly guided them to the final step: signing up and connecting with those advisors. Ensuring the process felt intuitive, secure, and aligned with their needs was crucial in transforming matched results into actual connections.

Outdated Visual Identity:

Wealthramp's old design did not match the level of professionalism or trustworthiness expected in the financial services sector.

Content Redundancy and Disorganization:

Key information was buried within the site or repeated across pages, making it difficult for users to find what they needed.

User Interface (UI) Issues:

The existing interface was not intuitive and did not deliver a smooth or engaging experience on both desktop and mobile.

Ineffective Content Strategy:

There were issues with how the content was structured and presented, which impacted the user’s ability to easily navigate the site and make informed decisions.

Our Approach

Every business has its own distinct needs, which is why we use a structured approach that creates clarity through design and technological choices. Learn more about Graham Agency's Brand Acceleration blueprint.

Solution:

A Seamless Redesign Focused on Trust, Engagement, and Conversion

To address the challenges, we implemented a comprehensive redesign that balanced both aesthetic appeal and functionality. Our solution combined modern design principles with a focus on user-centric navigation and streamlined content presentation, creating a seamless and engaging experience that drove conversions. This approach included:

Revitalized Brand Identity: A Modern and Trustworthy Design

We crafted a sophisticated and professional visual identity that reflected Wealthramp’s expertise in the financial services industry. The refreshed branding featured a contemporary color palette, elegant typography, and impactful visuals designed to inspire trust and appeal to users seeking reliable financial advice. This new identity was consistently applied across all touchpoints, including the website’s UI, mobile interfaces, and digital content, ensuring a unified and cohesive user experience.

UX/UI Redesign: Optimized for Intuitive Interactions

Through in-depth user research and wireframing, we gained key insights into the target audience's needs and preferences. This research informed the creation of a mobile-responsive UX/UI, ensuring an optimal experience across all devices. We prioritized seamless navigation and intuitive interfaces, making it easier for users to quickly find and engage with the advisor matching tool. The redesigned flow guided users effortlessly through the questionnaire, helping them connect with the right advisor and move through the sign-up process with confidence.

Content Strategy Overhaul: Streamlined and Engaging

We identified and eliminated redundancies in the existing content, restructuring it for clarity and coherence. This overhaul improved user engagement and made the content more informative and easier to digest. We also optimized the content for SEO, ensuring better search engine discoverability and added value for users searching for financial advice.

Reworked Site Architecture: Simplified User Journey

A new information architecture was implemented to simplify navigation, allowing users to easily access relevant content. We streamlined the content structure to reduce friction in the user journey, making it easier for visitors to find what they needed and complete the steps to connect with their ideal fiduciary advisor.

Results:

Driving Engagement, Trust, and Conversion

The redesigned website has delivered impressive results, significantly enhancing user engagement, trust, and conversion rates. Key improvements include:

Enhanced User Experience:

The redesigned website now offers a smooth and engaging experience on both desktop and mobile devices. Users can easily navigate through the site and efficiently complete the advisor matching process, improving their journey from start to finish.

Strengthened Trust and Credibility:

The new visual identity instills professionalism and reliability, key traits in the financial services industry. The modern design reassures users, fostering trust and establishing Wealthramp as a credible authority.

Improved Content Engagement:

The optimized content strategy allows visitors to quickly find the information they need. This has resulted in lower bounce rates and increased time spent on the site, indicating a more engaging and valuable user experience.

SEO Boost:

The improved content structure and SEO-focused changes have made the website more discoverable by search engines, increasing organic traffic. Wealthramp’s services are now reaching more potential users actively searching for trusted financial advisors.

Let's build something great

Ready to unleash your business vision?